When Do I Pay Quarterly Taxes 2024. Required payment deadline for any taxable income earned from april 1 to may 31, 2024. But it might not be an accurate amount if you.

I ncome tax return (itr) filing 2024: The 8% rate went into effect in late 2023 and is the highest since early 2007.

Am I Required To Make Estimated Tax Payments?

Taxpayers need to file a form 1040 (or.

Employers Engaged In A Trade Or Business Who Pay Compensation Form 9465.

Ccj) today reported its consolidated financial and operating results.

Just Two Years Ago, In.

Images References :

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

IRS Refund Schedule 2024 When To Expect Your Tax Refund, Ccj) today reported its consolidated financial and operating results. Taxpayers need to file a form 1040 (or.

Source: www.youtube.com

Source: www.youtube.com

How to pay estimated quarterly taxes to the IRS YouTube, Am i required to make estimated tax payments? You can pay all of your quarterly taxes for the upcoming year by the first quarterly deadline of the year in april.

Source: marylindawhynda.pages.dev

Source: marylindawhynda.pages.dev

2024 Tax Payment Dates Perle Brandice, Tax deposit deadlines vary depending on factors such as the type of return and past filing history, differing from. As the irs explains, a year has four payment periods with the following quarterly payment due dates:

Source: www.gkaplancpa.com

Source: www.gkaplancpa.com

How to Pay Taxes Quarterly A Simple Tax Guide for the Self Employed, When do you need to pay quarterly taxes? January marks the start of the 2024 tax filing season , but there are.

Source: www.everlance.com

Source: www.everlance.com

The Best Guide to Paying Quarterly Taxes Everlance, Tax deposit deadlines vary depending on factors such as the type of return and past filing history, differing from. Quarterly estimated tax payments for the 2024 tax year are due april 15, june 17, and.

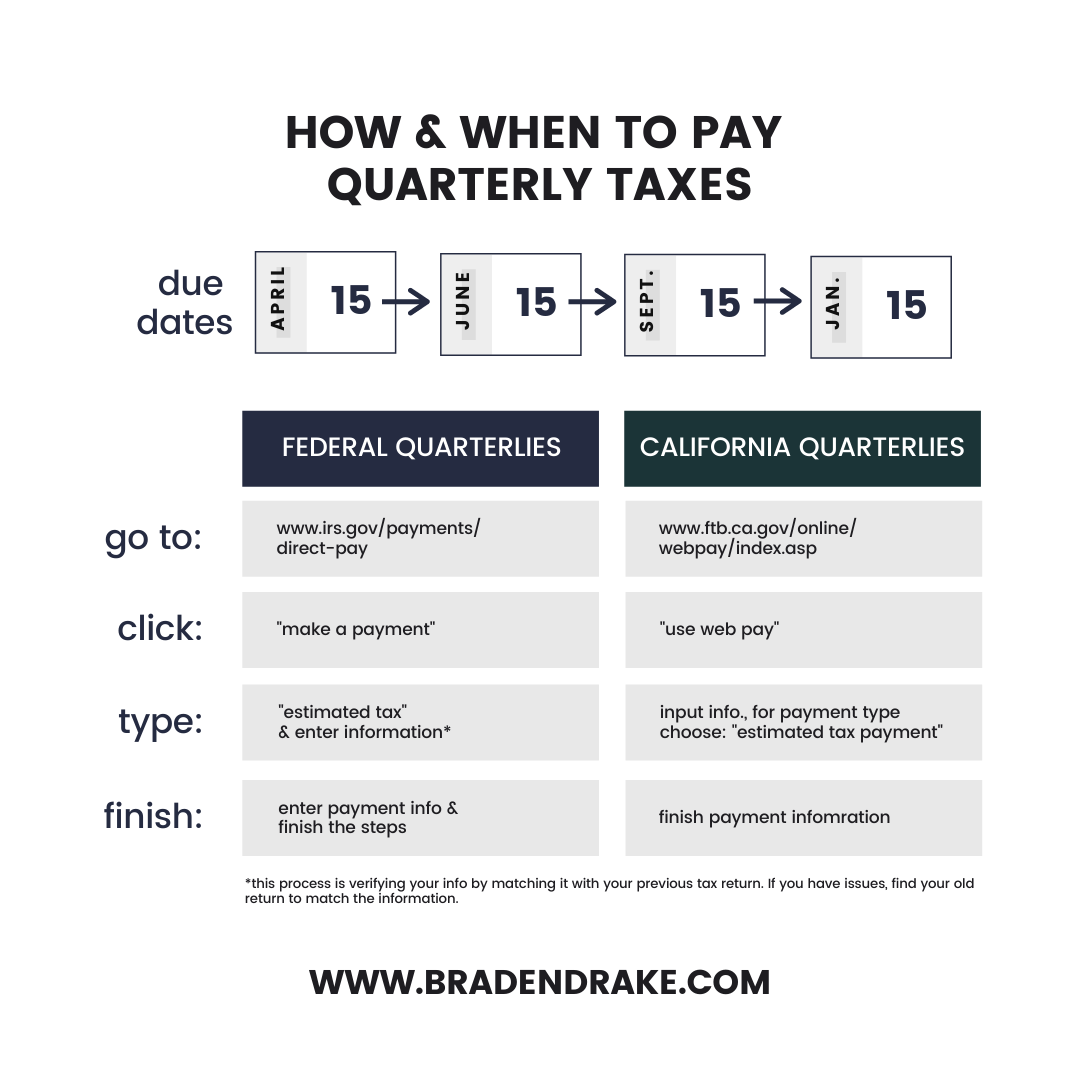

Source: www.bradendrake.com

Source: www.bradendrake.com

How to Calculate and Save Your Quarterly Taxes, Estimated quarterly tax payments are due four times per year, on. But it might not be an accurate amount if you.

Source: sosannawlexi.pages.dev

Source: sosannawlexi.pages.dev

How Much Tax Do I Owe For 2024 Daisie Arluene, Quarterly tax payments are due every 3 months. Estimated tax payments are commonly referred to as quarterly payments, even though they might not necessarily be three months apart or cover three months of income.

Find Out The Penalty For Not Making Quarterly Tax Payments, January marks the start of the 2024 tax filing season , but there are. These deadlines are crucial to avoid penalties.

Source: www.youtube.com

Source: www.youtube.com

How to Calculate Quarterly Estimated Tax Payments "UNEARNED", Taxpayers need to file a form 1040 (or. The final quarterly tax payment for 2023 was due by january 16, 2024.

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg) Source: fallonqlouisette.pages.dev

Source: fallonqlouisette.pages.dev

Taxes Due Date 2024 Lucie Imojean, Most individual income tax returns for the 2023 tax year are due to the internal revenue service on april 15, 2024. This table below shows the irs deadlines for paying estimated quarterly taxes.

For Most Taxpayers, The Deadline To File Their Personal Federal Tax Return, Pay Any Tax Owed Or Request An Extension To File Is Monday, April 15, 2024.

Estimated quarterly tax payments are due four times per year, on.

Irs Federal Tax Payments Deadline 2024.

You anticipate the withholding and tax credits will be less than 90% of your estimated tax liability for 2024 or 100% of your 2023 year tax liability (assuming it covers.